OUR APPROACH

How we make proven farm tools affordable

Our model helps smallholder farmers access affordable finance to invest in productive assets that raise their incomes. By allowing farmers to use the asset itself, such as a water tank or storage bag, as collateral, asset-collateralised loans (ACLs) lowers the barriers to entry: farmers don't need land titles, guarantors, or large deposits, and lenders face less risk.

Because the asset holds value and generates income, repayment rates are high and interest rates can remain fair, productive investment can be made affordable for farmers.

By partnering with Savings and Credit Cooperatives (SACCOs) and agricultural cooperatives, we make lending fair, accessible, and sustainable, enabling farmers to invest in income-boosting tools while giving lenders a safe, profitable way to reach rural markets.

What we do

Better Season Project acts as a technical partner, not a lender. We co-design, test, and evaluate asset-backed lending models with SACCOs and cooperatives. Our work combines product design, farmer engagement, and rigorous monitoring and evaluation - generating the data and insights needed to refine lending models, demonstrate impact, and build scalable, evidence-backed solutions.

Technical Advice

We work with SACCOs to design and deliver asset-backed finance products that are affordable, profitable, and easy to scale.

Farmer Outreach

We work with cooperatives to build farmer awareness and trust in productive tools and fair finance.

Monitoring

We collect and analyze data from every program to track impact, repayment, and climate resilience.

OUR PILOT

Water Tanks in Kenya

Water tanks are our starting point - a simple, proven asset with clear benefits for both farmers and lenders.

Why this works for farmers?

Reliable access to water is one of the biggest barriers in dairy farming. With a water tank, farmers can:

- Boost milk yields by ensuring livestock have water

- Save time, especially for women who collect water.

- Decrease cow morbidity

- Strengthen climate resilience

Why this works for lenders?

Dairy farmers are ideal borrowers: they have consistent income from milk sales, creating predictable cash flows that align with loan repayments.

Water tanks are ideal assets: they directly boost productivity and income, depreciate slowly, and have a strong resale market.

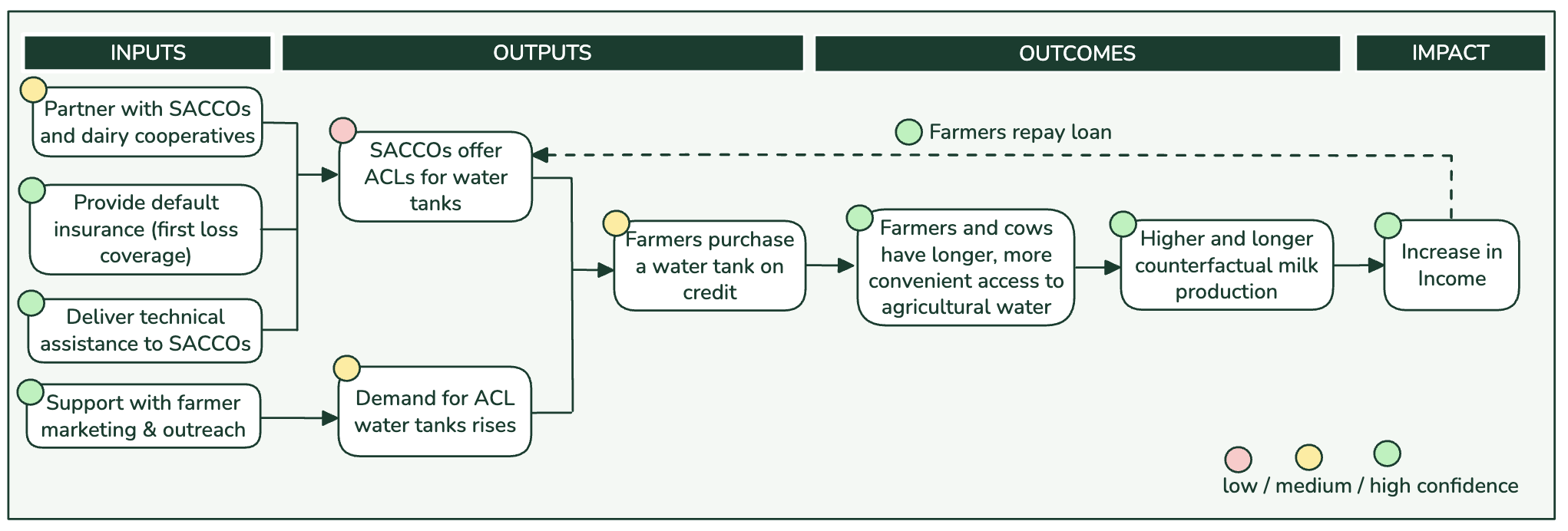

Our Theory of Change

OUR EVIDENCE

The core research behind our model

We are replicating findings from a randomized controlled trial (RCT) in Kenya led by Nobel Prize-winning economist Michael Kremer, which examined the effects of providing affordable credit for rainwater-harvesting tanks to smallholder dairy farmers. A subsequent 10 year follow up shows the persistence of these effects.

Core RCT Results - Water Tanks in Kenya

Studies suggest additional benefits such as girls’ school attendance, animal welfare, and improved household water access. We have not factored these effects into our impact estimates, keeping our assumptions deliberately conservative.

Why ACLs can work when microfinance sometimes fails

Traditional microfinance has delivered mixed results. A systematic review of 38 studies in Kenya found that while most programs improved household welfare, results varied widely depending on how loans were structured.

ACLs address the common pitfalls of traditional microfinance by:

- Financing income-generating assets that raise long-term incomes rather than short-term consumption.

- Lowering the risk of borrowers becoming over-indebted, since the asset itself provides loan security.

- Aligning incentives with farmers' interests, by working through member-owned SACCOs and cooperatives that share profits with farmers.